- Your website and online communications strategy should begin before your prospectus is issued.

- Have your online presence in place before all the work absorbs your team.

- Put the full set of investor pages live on your website as soon as your listing is happening.

Launching an initial public offering requires lots of planning. You’ll need all the help you can get, especially from the pros. You’ll want expert advice from specialists with a heaps of experience supporting companies on their primary listing on the ASX.

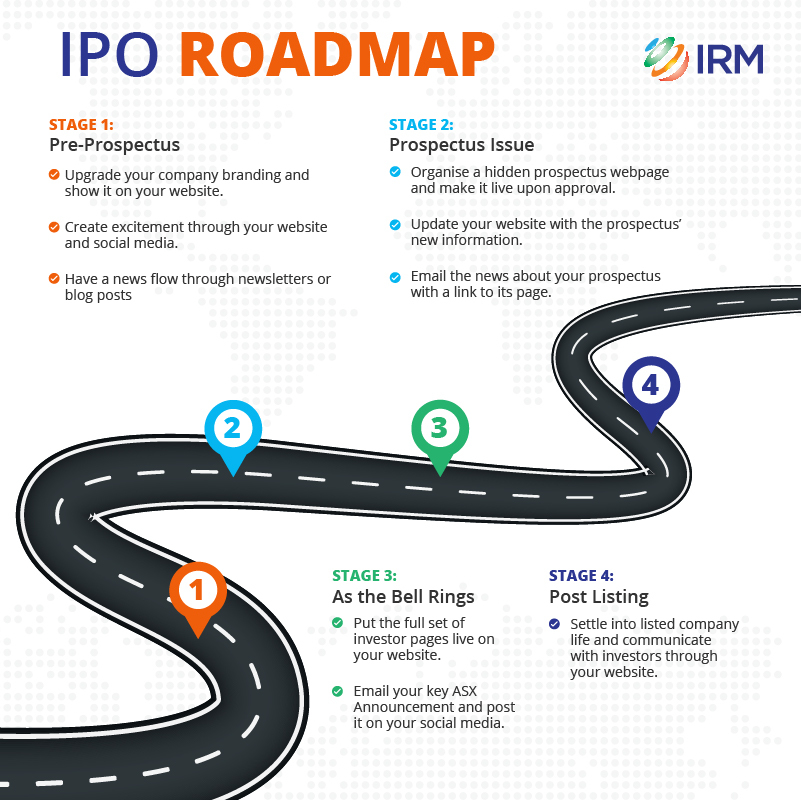

How about an IPO roadmap to great investor communications for your upcoming listing? With this guide, you’ll be able to cruise through the stages as your company goes public.

Stage 1: Pre-Prospectus

Ideally, your IPO website and online communications strategy should begin before your prospectus is issued or while it's being prepared. Here are some smart moves you can start with:

- Upgrade your company branding to reflect your new direction and show it on your website.

- Create excitement about your business through your website and online presence. Consider whether your latest investor content will be reflected in a new corporate website for all target audiences or in a specialised investor website that’s separate from your retail site. You may also choose to integrate information on your IPO as a series of investor features into your existing website.

- Have a news flow for current shareholders and potential investors through newsletters or blog posts. It’s important to keep investors informed quickly and easily as you progress to listing. This way you’ll embrace stakeholders with company news and updates during your IPO and beyond.

- Think about establishing your social media presence to post your news on platforms such as LinkedIn or Twitter.

Stir up interest about your company through your website, news and social media.

Stir up interest about your company through your website, news and social media.

Stage 2: Prospectus Issue

This is a busy time. Best to have your online presence in place before all the work absorbs the team! Some actions at this stage:

- Update your website with the new business descriptions being written for the prospectus (that are public so far).

- Prepare draft (unpublished) pages for your website with all the latest corporate information that can't be shown until the prospectus is released. Turn those pages on as the prospectus launches.

- Organise a hidden prospectus page, including the necessary legal disclaimers, approvals, etc. Upload the final document when it's finally approved and make the prospectus page live. Feature your prospectus and other new investor content on your home page.

- Email the news about your prospectus with a link to your website’s prospectus page to the subscriber list you prepared in earlier stages.

Highlight your prospectus and new investor content on your website.

Highlight your prospectus and new investor content on your website.

Stage 3: As the Bell Rings

As soon as the listing is happening, put the full set of investor pages live on your website. Email your key ASX Announcement to subscribers and post it to your social media accounts. Have it all set up in advance so it can simply be turned on while the bell is ringing.

Stage 4: Post Listing

After the transaction is done and you've settled into listed company life, it becomes apparent that you're largely on your own in communicating with investors. Your initial advisers and brokers have likely moved on to other transactions.

If you've managed your IPO process with a professional online investor presence throughout, your investors will not see you as an amateur public entity but a full scale ASX listed company from Day 1. Immediately, you’ll look more attractive to investors than all the other IPOs. Particularly if your post listing website already presents the full set of investor features of a listed company.

Acing your investor communications throughout the listing process will give you an edge over other IPOs.

Acing your investor communications throughout the listing process will give you an edge over other IPOs.

In a nutshell

A great investor communications strategy before, during and after your IPO process will help secure the success of your listing. Preparing your website and news flow well in advance will be key in having flawless communications with investors and stakeholders throughout the transaction.

Is your IPO on the horizon?

Let us help. IRM has supported companies through their IPO process and onwards, providing websites and news delivery services for effective online investor communications every step of the way. Check out our most recently listed clients here.

We understand costs are very important during this period. Speak to us on +61 2 8705 5444 or clientrelations@irmau.com to find out more about special deals for pre-listing, IPO and post-IPO clients.